MLD

MLD (Market Linked Debentures)

Market Linked Debentures (MLDs) are a type of non-convertible debenture (NCD) where the returns ai linked to the performance of a market benchmark, such as an index (e.g., Nifty 50, Sensex), governmer securities, interest rates, or commodities. Unlike fixed-income debentures that offer a predetermined coupon rate, MLDs provide returns based on the underlying asset's performance.

Key Features of MLDs:

Market-Linked Returns: Instead of a fixed interest payout, returns are dependent on the movement of the linked benchmark.

Tenure: Typically, MLDs have a tenure of 1 to 5 years.

Principal Protection: Some MLDs offer principal protection, ensuring that investors get back at least the initial investment amount.

Tax Benefits (Earlier): Before April 2023, MLDs were taxed as long-term capital gains (LTCG) at 10% if held for over a year. However, recent tax amendments have removed this benefit.

Risk Factor: MLDs carry both credit risk (issuer default) and market risk (linked index fluctuations).

Types of MLDs:

Equity-Linked MLDs: Returns depend on stock indices like Nifty 50 or Sensex.

Interest Rate-Linked MLDs: Returns vary with government bond yields or RBI policy rates.

Commodity-Linked MLDs: Tied to commodities like gold, silver, or crude oil.

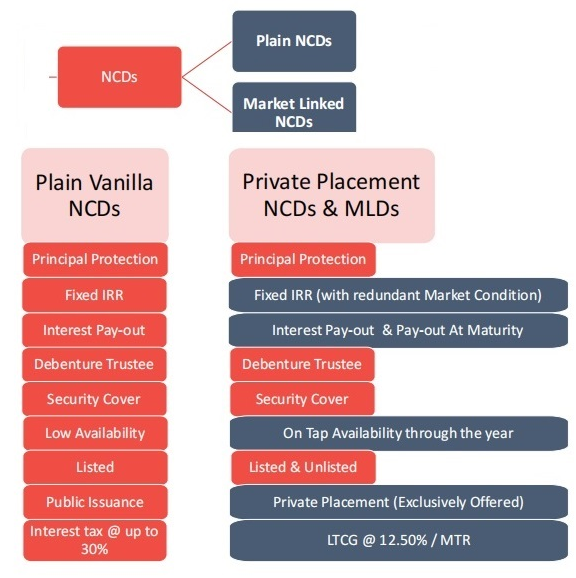

NCD vs Market Linked NCD

Examples of some of the MLD's currently available for subscription:

Nifty + 50 %

1.5X Return for each 1% Absolute Nifty Return

1X Return for each -1% Absolute Nifty Index Return

Tenure 42 Months

Nifty+65%

1.65X Return for each 1% Absolute Leap Index Return

1X Return for each -1% Absolute Leap Index Return

Tenure 42 Months

Nifty Mid Cap & Mid Cap Beta

Nifty Mid Cap

- 1X Return for each 1% Absolute Nifty Select Midcap Return

- Principal Protection in case Nifty Select Midcap is negative at maturity

- Tenure 42 Months

- Average First 6 months & Last 6 months

Mid Cap Beta

- 1.3X Return for each 1% Absolute Nifty Select Midcap Return

- Downside 1X for each -1% Absolute Nifty Select Midcap Return

- Tenure 42 Months

- Average First 4 months & Last 4 months

Twin Win - 6% FD + Nifty Return

Fixed Returns and Principal Protection1

Fixed Returns of 6.00% p.a.2 payable at maturity

Full Equity Upside , No Equity Downside

IN Nifty 50 indexes give more Than 6.00 % p.a , returns over 3 Years, Twin Win gives Nifthy 50 returns

In Case Nifty is down after 3 years ,you still get principal + fixed return

.png)

Edelweiss Twin Win

Twin win gives the higher of Fixed Return (6.00 % p.a ) Or Nifty Returns over 3 years

Thus no need to allocate between Dept and Equity, Twin gives you the best of both

Nifty AWE

Make Returns of Up-to 50%

AWE gives 50% absolute return1 if Nifty gives 10% absolute return over 3 years

Without Equity Downside Risk

Your Principal is protected2 in case Nifty falls after 3 Years

Truly All Weather

Over last 10 years, AWE has given at least 50%1 at least 88% times3