Mutual Fund Information

| Scheme: | Axis Childrens Fund - Lock in - Regular Growth | ||||||||||||||||||||||||||||||

| AMC Name: | Axis Mutual Fund | ||||||||||||||||||||||||||||||

| AMFI Code: | 135759 | ||||||||||||||||||||||||||||||

| ISIN Code: | INF846K01WJ1 | ||||||||||||||||||||||||||||||

| Launch Date: | 05-12-2015 | ||||||||||||||||||||||||||||||

| Asset Class: | Mixed Asset | ||||||||||||||||||||||||||||||

| Category: | Childrens Fund | ||||||||||||||||||||||||||||||

| Scheme Type: | Open Ended Schemes for subscription | ||||||||||||||||||||||||||||||

| Benchmark: | NIFTY 50 Hybrid Composite Debt 65:35 Index | ||||||||||||||||||||||||||||||

| Initial Investment Amount: | 5000.0 INR | ||||||||||||||||||||||||||||||

| Subsequent Investment Amount: | 100.0 INR | ||||||||||||||||||||||||||||||

| SIP Minimum Amount: | 1000 INR | ||||||||||||||||||||||||||||||

| SIP Auto Debit Dates: | 1,2,3,4,5,6,7,8,9,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28 | ||||||||||||||||||||||||||||||

| Total Assets: | 917.22 Cr As on (31-12-2025) | ||||||||||||||||||||||||||||||

| TER: | 2.29% As on (31-12-2025) | ||||||||||||||||||||||||||||||

| Turn over Ratio: | |||||||||||||||||||||||||||||||

| Volatility: | 10.09 | ||||||||||||||||||||||||||||||

| Sharpe Ratio: | 0.55 | ||||||||||||||||||||||||||||||

| Alpha: | -1.67 | ||||||||||||||||||||||||||||||

| Beta: | 1.1 | ||||||||||||||||||||||||||||||

| Yield to Maturity: | 7.36 | ||||||||||||||||||||||||||||||

| Average Maturity: | 19.1 | ||||||||||||||||||||||||||||||

| Scheme Objective | The investment objective of the scheme is to generate income by investing in debt & money market instruments along with long-term capital appreciation through investments in equity & equity related instruments. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. | ||||||||||||||||||||||||||||||

| Scheme Manager: | Mr. Jayesh Sundar, Mr. Devang Shah, Mr. Hardik Shah, Ms. Krishnaa N | ||||||||||||||||||||||||||||||

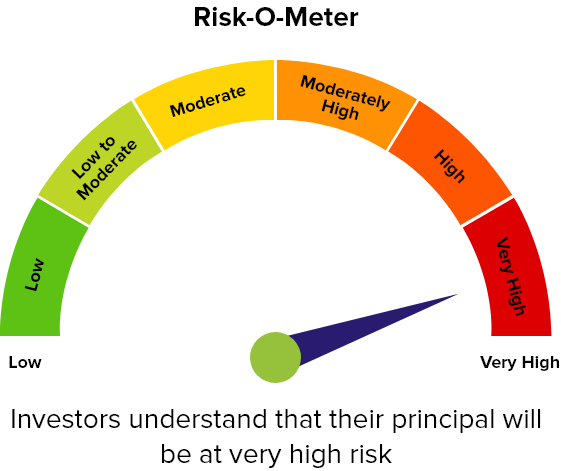

| Riskometer |

|

||||||||||||||||||||||||||||||

Scheme Performance

|

|||||||||||||||||||||||||||||||

Disclaimer : We have gathered all the data, information, statistics from the sources believed to be highly reliable and true. All necessary precautions have been taken to avoid any error, lapse or insufficiency; however, no representations or warranties are made (express or implied) as to the reliability, accuracy or completeness of such information. We cannot be held liable for any loss arising directly or indirectly from the use of, or any action taken in on, any information appearing herein. The user is advised to verify the contents of the report independently.

Returns less than 1 year are in absolute (%) and greater than 1 year are compounded annualised (CAGR %). SIP returns are shown in XIRR (%).

The Risk Level of any of the schemes must always be commensurate with the risk profile, investment objective or financial goals of the investor concerned. Mutual Fund Distributors (MFDs) or Registered Investment Advisors (RIAs) should assess the risk profile and investment needs of individual investors into consideration and make scheme(s) or asset allocation recommendations accordingly.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Past performance may or may not be sustained in the future. Investors should always invest according to their risk profile and consult with their mutual fund distributors or financial advisor before investing.